Your Phone is Now Your Card Reader

Empower your business with secure and convenient tap-to-pay functionality, straight from the device you already own.

Processing Fee: 2.49% + $0.10 per Tap to Pay transaction.

Getting Started is Just a Tap Away!

Quick Setup

Create your account and finish onboarding in minutes.

Download Our App

Install the mobile app and log in using your credentials.

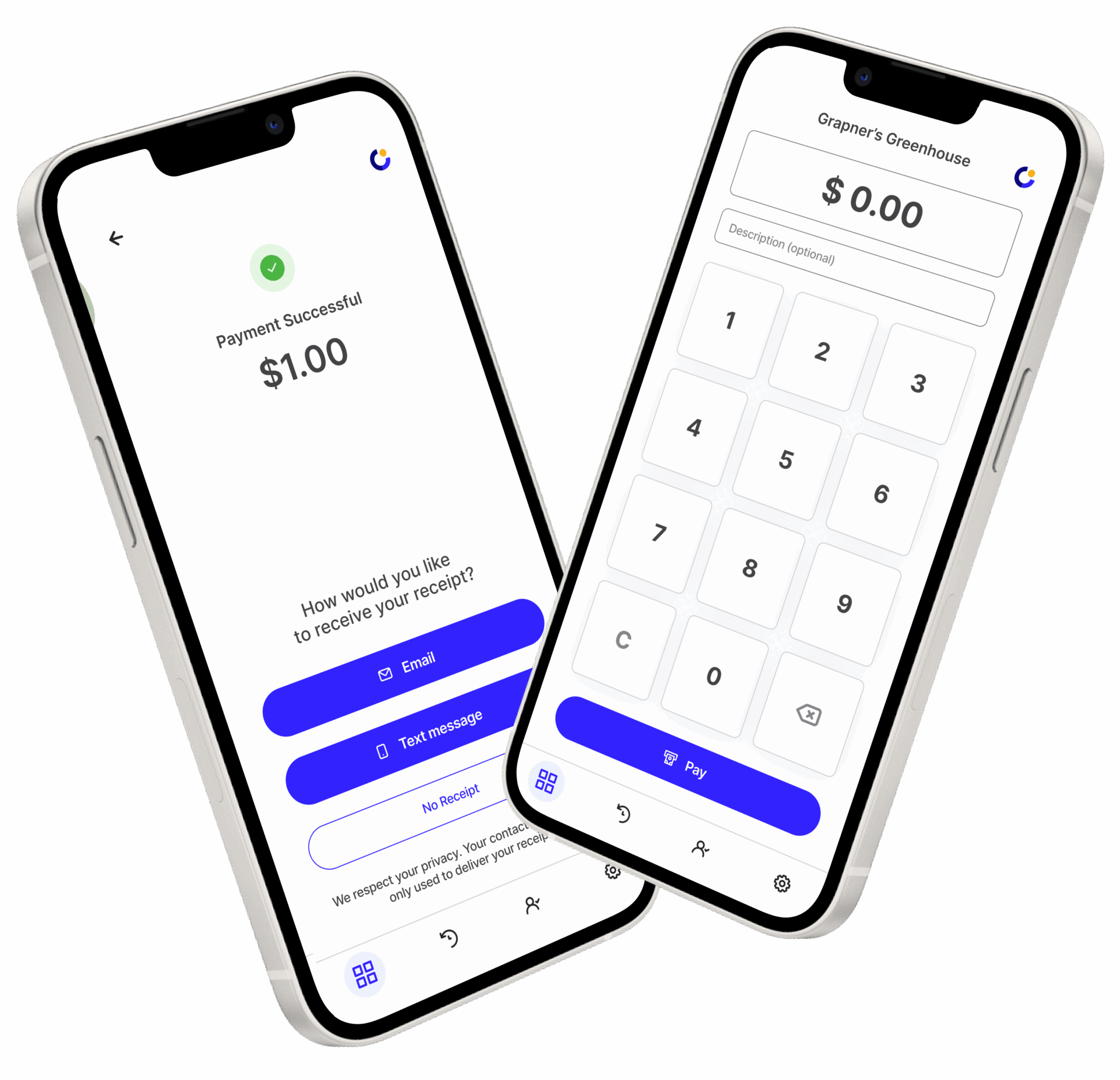

Enter Payment

Input the bill amount you wish to charge your customer.

Tap to Accept

Customers simply tap their card or phone on the back of your device.

Digital Receipts

Send receipts instantly via email or text.

Just 2.49% + $0.10 per Tap to Pay transaction.

Simplify How You Get Paid

Transform your phone into a payment powerhouse. Tap. Paid. Done.

No extra hardware

Cut the unnecessary costs. Forget about buying a terminal or paying rental fees. You already own the only device you need.

No credit check

Get approved instantly and start taking payments without anyone poking around your financial history.

No contracts

Use Tap to Pay on your terms. No long-term commitments and no fine print. Stick around because it works for you.

Made for Getting Paid Anywhere

Independent Retail Shops

Gift shops, specialty stores, kiosks, pop-ups

-

Easy in-store and on-the-go payments

-

Fewer declines at checkout

-

Fast payouts to keep cash flowing

Car Wash & Vehicle Care

Car washes, detailing services, memberships

-

Tap-to-pay anywhere on the lot

-

No terminals tied to a counter

-

Built for high-volume traffic

Clothing & Fashion Stores

Boutiques, apparel shops, fashion retailers

-

Smooth in-store tap-to-pay checkout

-

Fewer returns and chargebacks

-

Easy app built for small businesses

Service-Based Businesses

Salons, studios, trainers, local services

-

Easy payments per appointment

-

Tips and add-ons included

-

Start accepting payments in minutes

Auto Repair & Service Shops

Mechanics, garages, service centers

-

Take payments anywhere in the garage

-

Everyone can get paid on their phone

-

Get paid in person or by invoice

Home Services

Handymen, plumbers, renovation teams

-

Take deposits and progress payments

-

Get paid faster on large jobs

-

Clear records for every project

We’re on the side of small businesses

Running a business is already a lot. Payments shouldn’t make it harder.

CPOS helps individuals and small teams accept payments and get paid without extra devices or complicated setups. Use your phone, use a terminal, or mix both.

Thousands of businesses trust CPOS every day, processing billions in payments each year. We believe small businesses keep communities alive, and they deserve tools that are fair, reliable, and easy to use. That’s what we focus on. Nothing more, nothing less.

12

+

5826

1,183,611,803

$

Transparent Pricing

Processing Fees

— Tap To Pay (card present): 2.49% + $0.10

— Online (card not present): +1% + $0.20

— International Cards: +1% + $0.20

Payouts to your bank account

— United States: Next-day payout

— Canada: 3-day payout

— Australia: 2-day payout

— Free, 0% fee

* Your very first payout may take up to 7 days due to additional security review.

Software Subscription

— $20 per month for full access to Tap to Pay features: tips, taxes, invoicing.

— 14-day free trial to get things set up and see whether it’s the right fit.

.png?width=1280&height=720&name=visa%20(1).png)